Silver Law is an exceptional team of New Mexico criminal tax lawyers that bring over 50 years of combined experience into everything we do. We represent individuals and corporations who are involved with IRS investigations, and are licensed to handle tax controversy in state and national courts.

Expert Criminal Tax Defense Law Firm In New Mexico

When you need a capable New Mexico federal tax law attorney, Silver Law PLC is an excellent solution. We are former IRS lawyers who can skillfully handle a variety of tax controversies with ease.

Common Criminal Tax Charges Silver Law PLC Defends Against

Our New Mexico tax lawyers are experienced in defending a variety of criminal tax charges, including tax fraud, tax evasion, and failure to file.

Allegations Of Criminal Tax Fraud

Let our New Mexico tax litigation lawyers at Silver Law PLC defend your rights as you face allegations of criminal tax fraud.

Criminal Tax Evasion Charges

Being charged with tax evasion is a serious situation and must be taken seriously. Contact our skilled lawyers for assistance right away!

Failure To File A Tax Return Accusations

When you are accused of failure to file a tax return or late filing, Silver Law PLC will defend your rights.

IRS Tax Debt Collection Lawyers

Because each of our New Mexico criminal tax defense lawyers was formerly an IRS lawyer, we have valuable insight on exactly what the IRS is looking for and how to confidently defend your rights against it.

Tax Litigation For US Tax Court & Federal District

Silver Law is prepared to defend clients against false charges from the IRS at both a local and a national level. This means we are on your side from start to finish, through local court and federal district court.

Innocent Spouse Relief

When one spouse understates taxes on their joint tax return and the other spouse is unaware of the errors, Silver Law can plead for innocent spouse relief on your behalf to ensure repercussions only affect the guilty party.

Failure To File A Tax Return

Whether you are falsely or accurately accused of failure to file a tax return, our New Mexico tax attorneys near you are ready to help you catch up on filing, while fighting for you to pay the lowest amount back.

Overstating The Amount Of Tax Deductions

Overstating your income on your tax return is easily remedied by having the difference added to your tax refund or decreasing the amount of taxes you owe. If you realize you made a mistake, contact Silver Law for guidance.

Underreported Income Charges

Any individual who states less income on their tax return than they actually received is subject to paying more taxes than initially anticipated. Let Silver Law guide you through the process to avoid unnecessary repercussions.

Licensed Tax Attorneys Representing Clients On IRS Tax Collection Cases

Silver Law is the best resource for anyone facing issues or a dispute with the IRS. Our team is available 24/7 for consultation, sound guidance, and to answer your questions about the charges against you. We proudly carry five-star ratings across the web and the AVVO Preeminent Rating for our consistent integrity and ethics, so give us a call today to get started.

Contact A Professional Criminal Defense Lawyer Today

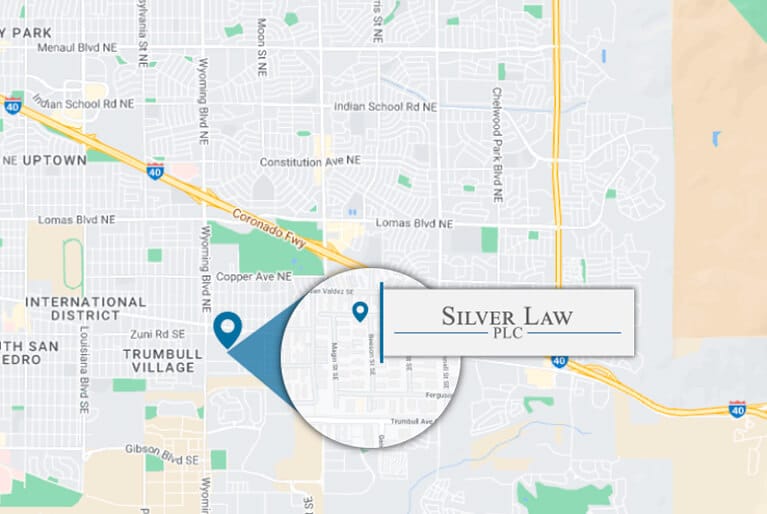

308 Magin St. SE

Albuquerque, NM 87123

Criminal Tax Case Representation From Former IRS Lawyers

As former New Mexico IRS attorneys, Silver Law has a comprehensive understanding of tax disputes that allows us to build a strong defense for you.

Avoid Tax Evasion Penalties With Our Criminal Tax Attorneys

Tax evasion is considered a felony and can result in hefty fines or a prison sentence. Let our capable lawyers handle your case, gather all the necessary information, and aggressively protect your rights.

Preeminent Law Firm On Tax Fraud Resolutions

Our attorneys at Silver Law PLC have a reputation for successfully representing clients faced with tax fraud allegations. We are skilled with New Mexico tax audit representation and are ready to defend your rights.

Criminal Tax Litigation Against IRS Disputes

When you need expert legal guidance to face a tax dispute with the IRS, the attorneys at Silver Law have an intimate knowledge of tax law that helps us successfully protect you and your business.

Contact A Professional Criminal Defense Lawyer Today

Frequently Asked Questions About Tax Crimes In New Mexico

What Is An IRS Special Agent?

IRS Special Agents represent the criminal investigations department of the IRS. Their job is to contact individuals or businesses who they believe are guilty of a tax crime and need to be investigated by the IRS.

Can You Go To Jail For Not Paying Taxes?

Failure to file a tax return or filing a fraudulent return can get you imprisoned for up to 5 years. Not filing a return can equal one year of jail for each year of not filling.

What Is The Difference Between Tax Avoidance And Tax Evasion?

Tax avoidance occurs when a person or business takes action to lessen their tax liability and maximize their after-tax income. Tax evasion occurs when there is deliberate failure to pay or underpayment of taxes due.

What Happens If You Are Found Guilty For Tax Evasion?

Tax evasion is a felony, with a maximum federal prison sentence of five years and a maximum fine of $100,000. This is a serious offense and should be avoided at all costs by every tax-paying individual.

How Do I Know When to Hire a Tax Attorney?

Anyone facing a case involving tax relief concerns, issues that could lead to legal ramifications if convicted, or false accusations from the IRS, will benefit greatly from hiring a competent tax attorney. Doing so may lead to the best possible outcome for the situation, and the legal counsel received will be beneficial for years to come.

When Is The Right Time To Seek Help From A Tax Attorney?

The best time to hire a qualified tax attorney is when you feel the need for legal counsel regarding a situation. Whether you are facing a dispute with the IRS, are confused about how to claim certain income, or you simply want guidance as you work through a confusing tax issue, a tax attorney in New Mexico is a valuable resource.

What Are the Consequences If I Don't File My Taxes?

Anyone who fails to file their taxes on time, or even file them at all, will likely face a Failure to File penalty. This penalty includes 5% of your unpaid tax liability for each month that you fail to file, up to 25% of your total unpaid taxes. Contact an attorney right away if you are faced with this situation.

What Is the Difference Between A CPA And A Tax Attorney?

A tax attorney is a legal professional trained in tax law, and qualified to offer guidance regarding a dispute with the IRS, penalties for failure to file or wrongly claimed income, or litigation cases. A CPA is a certified, highly trained account with the credentials necessary to help individuals and businesses file their yearly taxes.

Testimonials

Extremely professional

“If you have any kind of Tax issue and don’t go here you are making a mistake. Extremely professional, caring, and very well done. Highly recommended.”

Ken S. ★★★★★

Extremely knowledgeable and quick response

“Extremely knowledgeable. Always a quick response to emails and phone calls! Silver Law is a great company and would recommend them to anyone.”

Dustin V. ★★★★★

Reply to my concerns

“Jason resolved problems for me and my business that I saw no end to. He enabled me to successfully run and reestablish my business while he handled all my tax issues. His replies to my concerns were very thoughtful and prompt. If I’m ever in need again, their will be no hesitation in calling Jason.”

Douglass J. ★★★★★

They have a answer to any doubt

“Jason helped our business through an audit. Having him there on our side was a great comfort! He has a answer/response to everything and was able to make sure that we were not penalized one penny!”

Michael S. ★★★★★

Visit Our Tax Law Firm Near New Mexico

308 Magin St SE,

Albuquerque, NM 87123, USA

Hours:

Monday thru Friday

9:00 am – 5:00 pm

(505) 295-5796

taxcontroversy.com

lchapman@silverlawplc.com

View Map | Get Directions

Legal Representation For Tax Issues Throughout New Mexico

Facing Tax Penalties In Albuquerque?

Contact Our Lawyers!

Don’t try to fight tax penalties on your own! Contact our qualified attorneys at Silver Law for help getting the penalty lowered.

Have Unpaid Taxes In Las Cruces?

Our Attorneys Can Help!

Schedule a totally free consultation with the Las Cruces tax attorneys at Silver Law for guidance on making a plan to pay back overdue taxes.

Did You Fail To File Your Taxes In Rio Rancho?

Let Us Know!

Don’t worry! Silver Law has your back as we help you file overdue taxes and avoid excessive penalties from the IRS.

Did You Receive A Math Error Notice In Santa Fe?

Reach Out To Us!

If you have been notified of a math error on your tax filing, we can help make the correction process smooth and painless.

Are You Being Audited By The IRS In Roswell?

Call Us Today!

Reach out to our team at Silver Law immediately if you are being audited by the IRS. We will walk with you though the entire process.